Our Templates

Explore

Useful Links

- Privacy Policy

- Terms & Conditions

- Cookie Policy

- Consent Settings

Discover the easiest way to manage payroll with our comprehensive suite of tools. Whether you're looking to generate paystubs, create checkstubs, or streamline payroll processes, we've got you covered.

Create professional paystubs effortlessly with our intuitive paystub maker. Perfect for small businesses and self-employed individuals, our tool ensures accuracy and compliance.

Generate detailed checkstubs quickly and securely. Our checkstub maker offers customizable templates to meet your business needs, making payroll management a breeze.

Access your payroll information anytime, anywhere with our online payroll solutions. From employee paystubs to digital checkstubs, manage your payroll with ease.

Tailor your paystubs and checkstubs with customizable templates. Maintain professionalism and clarity while reflecting your company's branding.

Rest assured knowing your payroll data is secure with our reliable service. Our secure paystub maker and generator prioritize data protection and confidentiality.

Save time with our fast and convenient paystub generator. Instantly create and print paystubs, ensuring timely payroll processing for your employees.

Enjoy affordable paystub solutions with transparent pricing. Whether you're a startup or a large corporation, our tools fit every budget without compromising on quality.

Leading Online Paystub Creator in the Market

Generate your paystubs within minutes. Our fully automated online paystub maker system streamlines the process, saving you time and effort by eliminating manual calculations.

Benefit from precise and up-to-date calculations.

Choose from multiple professionally designed templates for employee paystubs that are ready for immediate use.

Receive your paystub documents in PDF instantly via email upon purchase, ready for download and use.

Easily create paystubs for yourself, your employees, or your independent contractors in just a few minutes.

Our dedicated support team is available around the clock to assist you.

Generate your paystub effortlessly through our streamlined four-step process.

Enjoy a hassle-free experience with our completely automated paystub creation tool.

Choose from a variety of professionally designed, modern templates.

Make changes and amendments to your order within seven days of purchase

Receive your paystub directly in your inbox immediately upon purchase.

Easily download your documents in PDF format for printing.

Our support team is available around the clock, with most queries resolved within four hours.

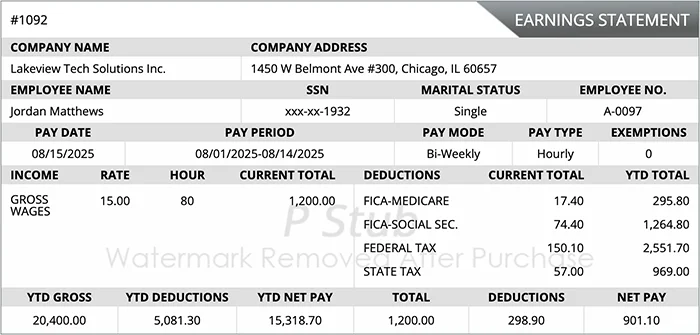

A paystub, also known as a paycheckstub or pay slip, is a document that details an employee's earnings and deductions for a specific pay period. It typically accompanies a paycheck and provides a comprehensive breakdown of the following information:

Paystubs serve as a record for employees to understand their compensation and deductions. They are also useful for various purposes such as verifying income for loans, rental applications, and tax filings.

Paystubs are typically needed by employees, contractors, freelancers, and anyone else who requires documentation of their earnings and deductions for financial or official purposes.

We use different types of cookies to optimise your experience on our website. You may choose which types of cookies to allow and can change your preferences at any time. Remember that disabling cookies may affect your experience on the website. You can learn more about how we use cookies by visiting our Cookie Policy.

These cookies are necessary to the core functionality of our website and some of its features, such as access to secure areas.

Enable the Website to remember your choices, such as language or region, and provide enhanced, more personalized features.

Collect data on how you interact with our Website, such as the pages you visit most frequently, to help us improve its performance and your overall experience.

Used to display advertisements relevant to your interests. These cookies may also limit the number of times you see an ad and help assess the effectiveness of advertising campaigns.

These are the cookies that do not belong to any other category or are in the process of categorization.